The automotive industry is a powerhouse of innovation, but even in an age dominated by advanced electronics and complex systems, some foundational components remain indispensable. The leaf spring, a simple yet effective form of suspension, is one such component. Comprising multiple layers of curved metal (or composite) plates, it is a workhorse in the suspension architecture, particularly favored for its high load-bearing capacity, simplicity, and durability. The automotive leaf spring market is not just surviving; it is evolving, driven by the unwavering demands of the commercial vehicle sector and advancements in material science. This guest post will delve into the critical aspects of this market, covering its size, key segments, growth opportunities, challenges, demand drivers, and the latest trends shaping its future.

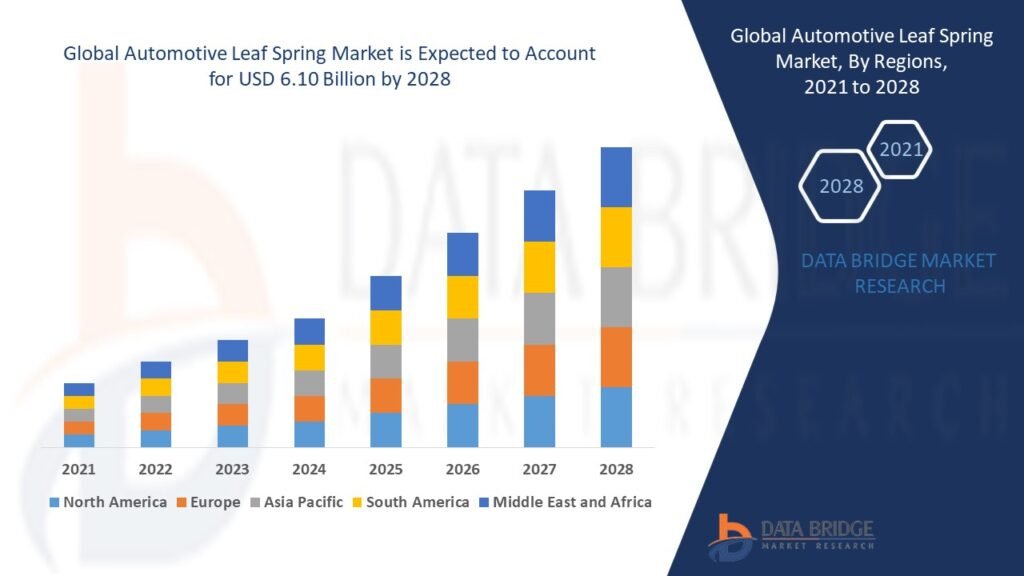

The automotive leaf spring market size is valued at USD 6.10 billion by 2028 and is expected to grow at a compound annual growth rate of 6.20% over the forecast period of 2021 to 2028.

Gain clarity on industry shifts, growth areas, and forecasts in our Automotive Leaf Spring Market report. Get your copy:

https://www.databridgemarketresearch.com/reports/global-automotive-leaf-spring-market

Market Size and Scale

The global automotive leaf spring market demonstrates robust, steady growth. Industry valuations place the market size at approximately USD 4.87 billion to USD 7.11 billion in 2024, with projections indicating a rise to between USD 6.1 billion and USD 12.18 billion by 2031-2033. This expansion is typically forecasted at a Compound Annual Growth Rate (CAGR) ranging from 3.15% to over 6% during the forecast period. This growth is intrinsically linked to the global expansion of the automotive and logistics sectors. The sheer volume of vehicle production, especially in developing economies, provides a continuous stream of demand for these essential suspension parts in both original equipment manufacturing (OEM) and aftermarket segments.

Market Share: A Segmented Landscape

The market share within the automotive leaf spring sector is clearly delineated by material, spring type, and vehicle application.

- By Vehicle Type: The Medium and Heavy Commercial Vehicles (MHCVs) segment is the dominant force in the market. Trucks, buses, and trailers rely heavily on leaf springs for their proven ability to handle substantial payloads and endure rough terrains, often accounting for a significant majority of the market’s revenue share, sometimes exceeding 50%. However, the Light Commercial Vehicles (LCVs) segment, driven by the booming e-commerce and last-mile delivery industries, is expanding rapidly and is expected to exhibit the fastest growth, often fueled by the use of leaf springs in vans and pickup trucks.

- By Material: Traditional steel leaf springs still command the largest market share, estimated to be over 70% to 75% in 2024. Steel is favored for its cost-effectiveness, established manufacturing processes, durability, and reliability in heavy-duty applications. Nevertheless, composite leaf springs (made from materials like fiberglass or carbon fiber-reinforced polymer) represent the fastest-growing material segment. While their market share is currently smaller, the drive for vehicle lightweighting is propelling their adoption.

- By Spring Type: The semi-elliptical leaf spring configuration is the most widespread due to its reliability and common use in commercial vehicles. However, parabolic leaf springs are gaining traction, driven by their lightweight design and improved ride comfort compared to traditional multi-leaf setups.

Market Demand: The Engine of Growth

The demand for automotive leaf springs is fundamentally driven by several critical factors:

- Commercial Vehicle Production Boom: The escalating need for efficient logistics and transportation globally, particularly in Asia-Pacific economies like China and India, directly translates into high demand for MHCVs and LCVs, the primary users of leaf springs.

- Aftermarket Replacement Cycles: Leaf springs, subject to constant stress, have a defined service life. The large and aging global fleet of commercial and utility vehicles ensures a consistent and significant aftermarket demand for replacements and upgrades.

- Infrastructure Development: Large-scale infrastructure and construction projects globally necessitate heavy-duty vehicles, which in turn fuels the requirement for robust suspension systems like leaf springs.

- Cost-Effectiveness and Durability: Compared to more complex air or coil suspension systems, leaf springs offer a cost-effective solution with excellent load-bearing capabilities, making them the preferred choice for price-sensitive fleet operators.

Market Trends: Innovation in a Traditional Component

The automotive leaf spring market is undergoing transformation, incorporating modern trends to stay competitive:

- Lightweighting with Composites: The most significant trend is the shift towards composite leaf springs. Made from materials like fiberglass-reinforced polymers, these springs can reduce weight by up to 70% compared to steel. This weight reduction directly contributes to better fuel efficiency (or increased range in Electric Vehicles), lower emissions, and greater payload capacity, aligning perfectly with stringent global environmental and fuel economy regulations.

- Adoption of Parabolic Designs: There is a growing preference for parabolic leaf springs over traditional multi-leaf springs, even in commercial vehicles. Parabolic designs use fewer, thicker leaves, offering a better blend of load capacity, reduced weight, and improved ride comfort and handling.

- Advanced Materials and Coatings: For steel springs, manufacturers are investing in advanced high-strength steel alloys and new corrosion-resistant coatings. These developments enhance the springs’ fatigue life, durability, and resistance to environmental wear, thereby increasing their reliability.

- Digitalization in Manufacturing: The use of advanced manufacturing techniques, including simulation, Finite Element Analysis (FEA), and smart manufacturing, is leading to more optimized leaf spring designs, ensuring higher precision, lower material waste, and improved performance characteristics.

Market Opportunities

The evolving landscape presents several compelling opportunities for market players:

- Electric Vehicle (EV) Integration: The requirement for lightweight components to offset the weight of heavy battery packs in electric trucks and delivery vans creates a substantial opportunity for composite leaf springs and innovative parabolic designs.

- Aftermarket Performance Upgrades: The growing off-roading and customization culture, particularly for pickup trucks and SUVs, fuels demand for specialized, high-performance leaf springs and lift kits in the aftermarket.

- Geographic Expansion in Emerging Markets: Rapid industrialization, urbanization, and investment in logistics networks in the Asia-Pacific and Latin American regions offer untapped potential for both OEM supply and aftermarket sales.

- Smart Suspension Systems: Integrating Internet of Things (IoT) sensors into leaf spring assemblies for predictive maintenance can reduce fleet downtime and operating costs, creating a high-value niche market.

Challenges and Constraints

Despite the positive outlook, the market faces key challenges:

- Competition from Alternative Suspension Systems: The increasing adoption of air suspension and advanced coil spring systems in premium, heavy-duty, and passenger vehicles poses a significant competitive threat, particularly as cost and complexity barriers decrease.

- Raw Material Price Volatility: Steel remains the dominant material, and fluctuations in steel and alloy prices directly impact the manufacturing costs and profit margins for leaf spring producers.

- Design Trade-offs: The inherent trade-off between maximizing load capacity and optimizing ride comfort remains a core engineering challenge, although advancements in parabolic and composite springs are mitigating this to an extent.

- High Replacement Costs for Composites: While offering superior performance, composite leaf springs currently have a higher initial cost, which can be a barrier to mass adoption, especially in cost-sensitive commercial vehicle segments.

Conclusion

The automotive leaf spring market is a dynamic segment, deeply rooted in the heavy-duty and commercial vehicle sectors but rapidly embracing modern materials and design innovations. Its growth is guaranteed by the relentless expansion of global logistics and infrastructure. The future is clearly leaning towards lightweight, durable composite materials and smarter suspension solutions. By navigating the challenges of material costs and competitive alternatives, and aggressively pursuing opportunities in EV lightweighting and aftermarket upgrades, manufacturers can ensure that this foundational component continues to be a driving force—literally—in the global automotive industry.

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com