The hydrotreating catalysts market is entering a pivotal phase as refiners and petrochemical operators accelerate investments in efficiency, clean-fuel compliance, and sustainable process optimization. Stakeholders across the energy value chain are reshaping strategies to align with tightening regulations and evolving feedstock profiles. This is creating a competitive arena where innovation, operational resilience, and catalyst performance differentiation are driving market momentum.

Get a full overview of market dynamics, forecasts, and trends. Download the complete Hydrotreating Catalysts Market report: https://www.databridgemarketresearch.com/reports/global-hydrotreating-catalysts-market

Introduction

Hydrotreating catalysts play a mission-critical role in refinery operations. They remove contaminants such as sulfur, nitrogen, oxygen, and metals from various petroleum fractions. They support cleaner fuel production, enhance process stability, and protect downstream units. Rising pressure on refineries to deliver fuels with lower emissions and greater consistency is strengthening the value proposition of advanced hydrotreating catalysts. Market players are enhancing catalyst life, boosting activity levels, and engineering solutions that deliver higher throughput under demanding conditions. This environment is redefining the opportunity landscape while intensifying competition for technology leadership.

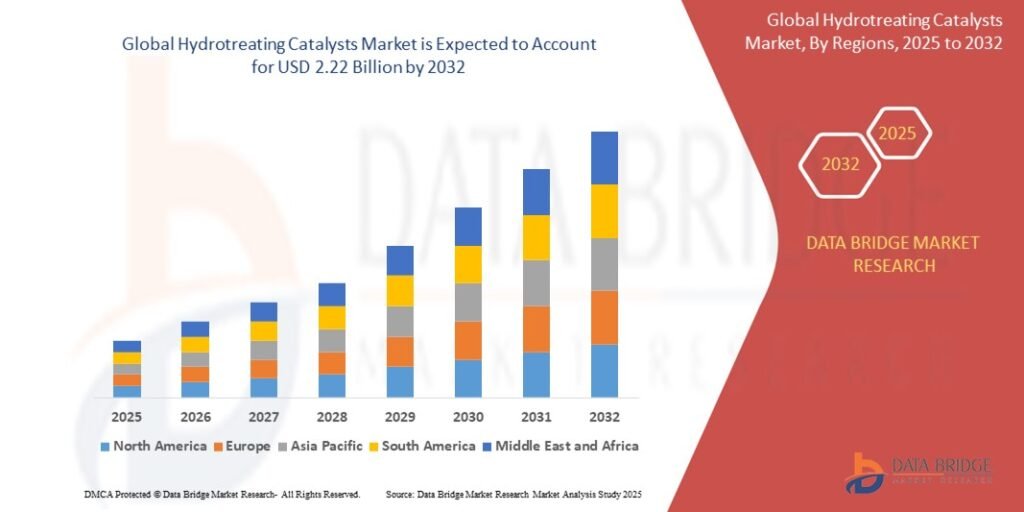

Market Size

The global hydrotreating catalysts market continues to scale as refineries modernize operations and respond to new regulations governing fuel quality standards. Demand from hydrodesulfurization and hydrodenitrogenation applications remains robust. Growth is supported by expansions in crude distillation capacity, the commissioning of new refineries in Asia and the Middle East, and sustained upgrades across mature markets. Investments in catalyst research and development are unlocking higher-value formulations, lifting market penetration across diverse processing environments. Market size expansion aligns with the broader shift toward clean energy compliance, making hydrotreating catalysts a recurring expenditure for refinery operators pursuing efficiency and longevity.

Market Share

The competitive landscape is defined by a concentrated mix of global technology providers, specialized catalyst developers, and integrated chemical manufacturers. Market share is influenced by performance metrics such as catalyst longevity, resistance to deactivation, activity under high-pressure conditions, and compatibility with varying feedstock qualities. Players with extensive technical support services and strong refinery partnerships are capturing a disproportionate share of recurring business. Proprietary metal loadings, advanced pore structures, and process-tailored designs are serving as key differentiators. Market consolidation trends are shaping the competitive hierarchy as organizations seek to expand production footprints, integrate R&D pipelines, and achieve operational scale.

Market Opportunities and Challenges

Opportunities are emerging across both established and developing refinery corridors. Ultra-low sulfur diesel compliance is accelerating catalyst replacement cycles. Upgrading of middle distillates, increasing use of opportunity crudes, and the push for enhanced reliability are creating new commercial openings. The petrochemical surge across Asia and the rise of integrated refinery-petrochemical complexes are generating strong demand for versatile catalyst systems capable of handling complex feed compositions.

Challenges remain significant. The high cost of advanced metals, volatility in raw material markets, and complex manufacturing processes impact pricing. Regulatory pressures around emissions and waste management influence catalyst formulation strategies. The shift toward renewable diesel and bio-feedstock hydrotreating introduces new technical demands that require re-engineered catalyst platforms. Balancing performance, cost efficiency, and sustainability remains a central challenge for market operators navigating evolving production mandates.

Market Demand

Market demand is scaling at a steady pace as refiners chase throughput optimization and environmental compliance. Hydrotreating catalysts remain essential to achieving low-sulfur benchmarks across diesel, kerosene, naphtha, and other core refinery streams. Refineries processing heavier or more contaminated crudes are driving substantial catalyst consumption. Demand is reinforced by the operational need for predictable catalyst cycles, stable reactor performance, and reduced downtime. End users are prioritizing catalysts that deliver enhanced yields, improved conversion reliability, and consistent activity across long operational runs. The market is also absorbing incremental demand from renewable fuel producers requiring specialized catalysts tailored to bio-derived feedstocks.

Market Trends

Technology advancement is shaping the trajectory of the hydrotreating catalysts market. Catalyst developers are increasing commitments to nano-structured materials, optimized pore geometries, and advanced metal dispersion techniques. These innovations elevate activity levels and improve tolerance to impurities. Digitalization within refinery operations is creating demand for catalysts that integrate seamlessly with predictive maintenance, monitored loading patterns, and data-driven performance evaluation.

Sustainability and circular-economy principles are taking center stage. Market participants are engineering catalysts with lower environmental footprints, enhanced recyclability, and reduced metal intensity. The transition to renewable diesel and sustainable aviation fuel is driving rapid development of catalysts engineered for vegetable oil, animal fat, and waste-oil hydrotreating. Refiners are deploying hybrid catalyst systems that deliver robust performance under diverse feedstock conditions.

Regional expansion is a prominent trend. Asia Pacific continues to dominate new capacity additions, positioning the region as the fastest-growing demand hub. The Middle East is scaling investments in integrated complexes, creating strong demand for advanced catalyst technology. North America and Europe are maintaining steady replacement cycles driven by regulatory pressures and refinery modernization initiatives.

Vendor collaboration with refiners is increasing as operators pursue tailored catalyst-process configurations that maximize return on investment. Technical service models and long-term supply partnerships are becoming strategic revenue drivers as buyers prioritize lifecycle performance over upfront cost.

The hydrotreating catalysts market is charting a growth trajectory supported by regulatory mandates, new refining projects, and evolving process requirements. Stakeholders who invest in next-generation catalyst technologies, adaptive supply chains, and high-impact R&D capabilities will secure competitive advantage in a market defined by innovation, performance intensity, and operational transformation.

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com